pay personal property tax richmond va

Please view our Hours Locations. Also you can elect to have the payments drafted.

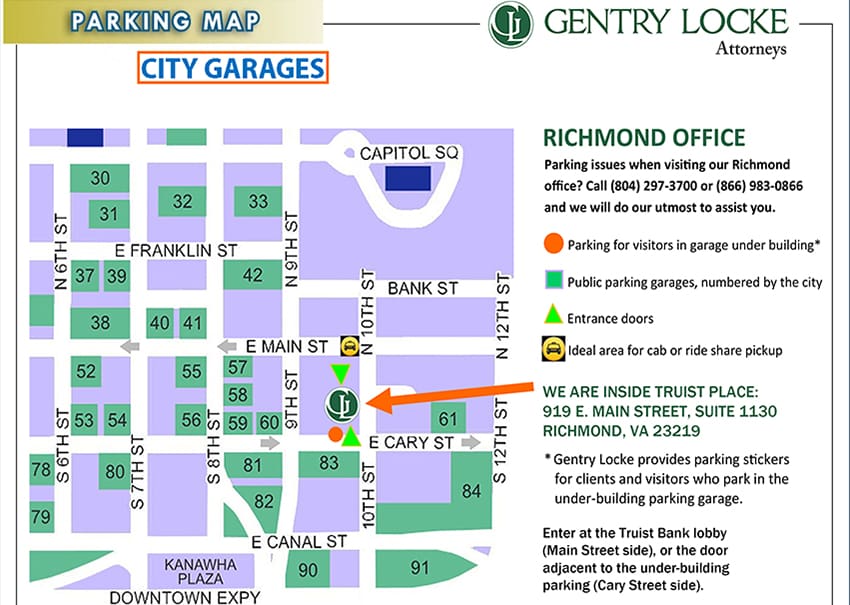

Visiting Our Richmond Office Gentry Locke Attorneys

Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly.

. Newport News VA 23607 Email Hours. Your tax account number which is located in the upper right corner of each tax statement. Pay all business taxes.

Personal property tax bills have been mailed are available online and currently are due June 5 2022. Make tax due estimated tax and extension payments. The tax rate for personal property in Calendar Year 2022 is 342 per 100 of assessed value or 86 cents less than the rate in Calendar Year 2021.

Vehicle is moved out to a non-prorating Virginia jurisdiction. Taxpayers can either pay. Selecting options for consulting taxes.

The county also can. In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region. Tax rates differ depending on where.

WRIC Richmond residents will have an extra two months to pay their personal property taxes after the City. Prepayments are accepted if you would like to make payments in advance of the due date for real estate and personal property taxes. Boats trailers and airplanes are not prorated.

Henrico County now offers paperless personal property and real estate tax bills. If you do not have your statement available please call 804-748-1201 for further assistance. Then the tax is not prorated.

You cannot pay online with a credit or debit card. The County offers an automated payment plan that allows monthly payments to be automatically drafted from your bank account. The Henrico County Treasurers Office is located at.

Monday - Friday 830 AM - 430 PM. Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for. Prepayments are accepted if you would like to make payments in advance of the due date for real estate and personal property taxes.

Henrico County accepts electronic payments for personal property taxes real estate taxes utility bills parking tickets false alarm fees planning fees building inspection fees and elevator certif. Real Estate and Personal Property Prepayments. And pay with one click using creditdebit or your checking account.

PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL. Pay bills or set up a payment plan for all individual and business taxes. You have several options for paying your personal property tax.

1 View Download Print and Pay Richmond VA City Property Tax Bills. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. Online payment includes the existing.

Below are categories of assistance which can potentially limit tax payments for real. Access City of Virginia Official Website. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered.

Real Estate and Personal Property Prepayments. Jun 1 2022 0608 PM EDT. On this page you will find tax assistance programs for the City of Richmonds Department of Finance.

Main Street -Suite 300 -Richmond VA 23219 The mailing address.

Hanover Passes 20 Reduction In 2022 Personal Property Tax Bills Wric Abc 8news

City Of Richmond Bc Paying Your Property Taxes

Occupational Employment And Wages In Richmond May 2021 Mid Atlantic Information Office U S Bureau Of Labor Statistics

Richmond Mistakenly Overcharges 2 800 Residents In Personal Property Tax Bills Richmond Local News Richmond Com

Cost Of Living In Virginia 2022 Sofi

How Decades Of Racist Housing Policy Left Neighborhoods Sweltering The New York Times

Understanding Your Property Tax Bill Clackamas County

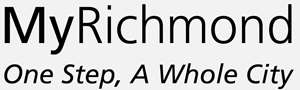

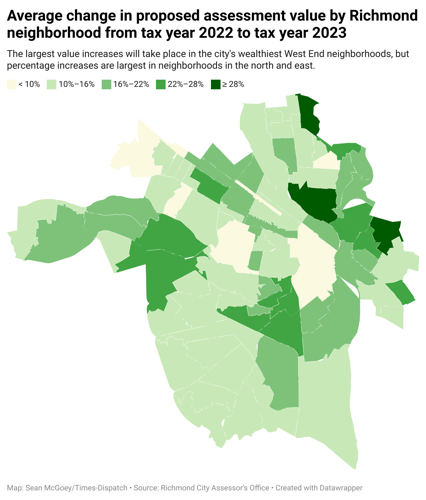

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

Easy Check Newport News Va Official Website

City Of Richmond Extends Personal Property Tax Deadline To August Wric Abc 8news

Richmond To Maintain Real Estate Tax Rate After Considering 6 5 Cent Rollback To Offset Rising Property Values Richmond Latest News Richmond Com

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

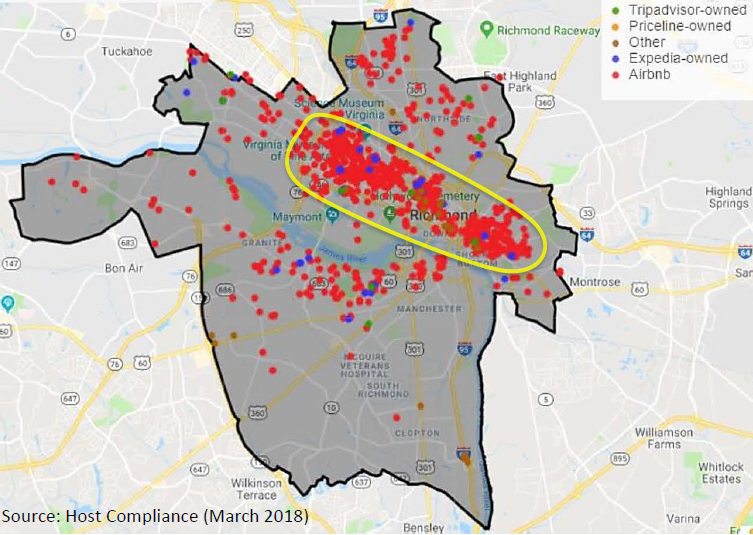

Richmond Adopts Rules For Airbnb Style Home Rentals Declares Public Safety Building As Surplus Richmond Bizsense

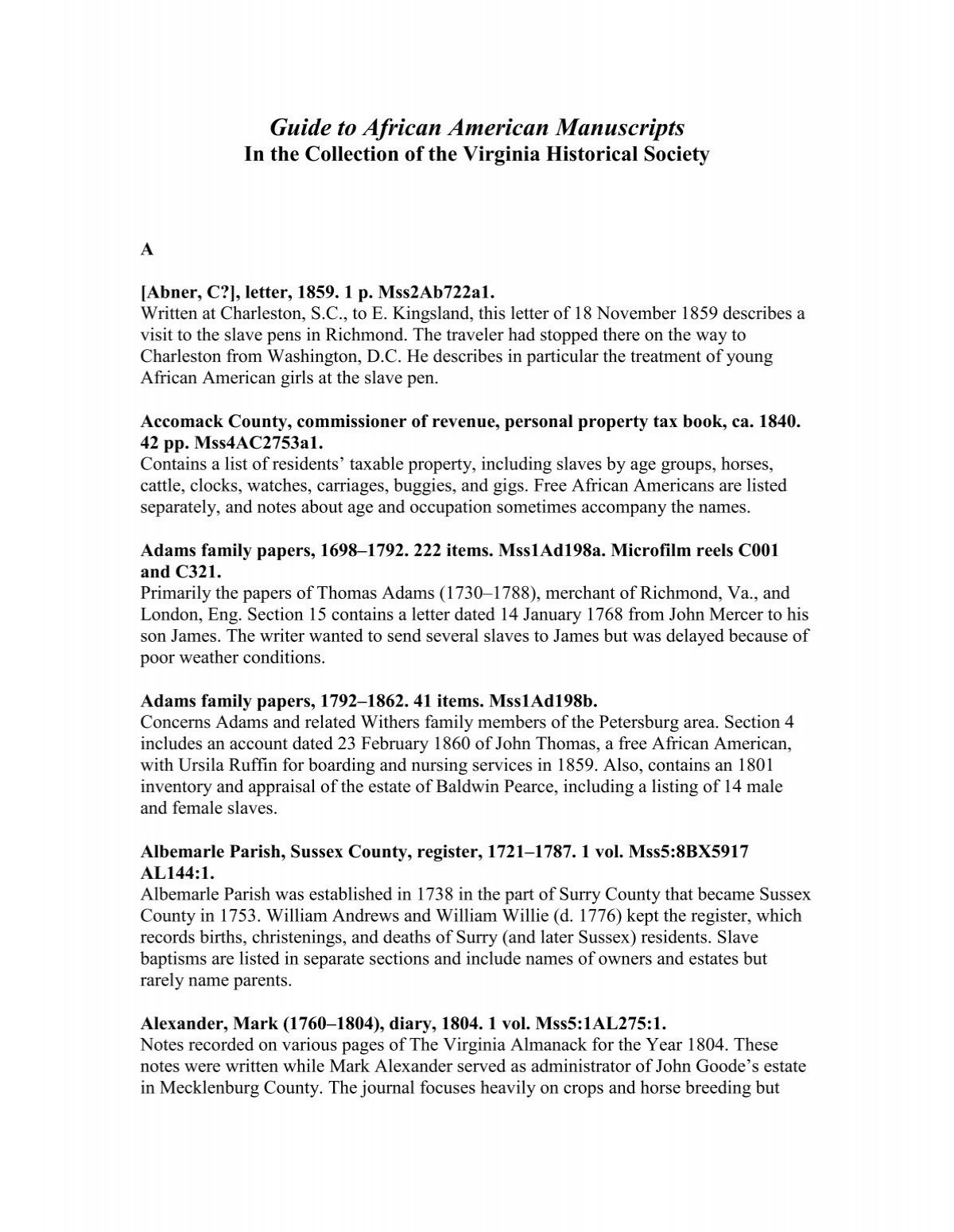

Guide To African American Manuscripts Virginia Historical Society

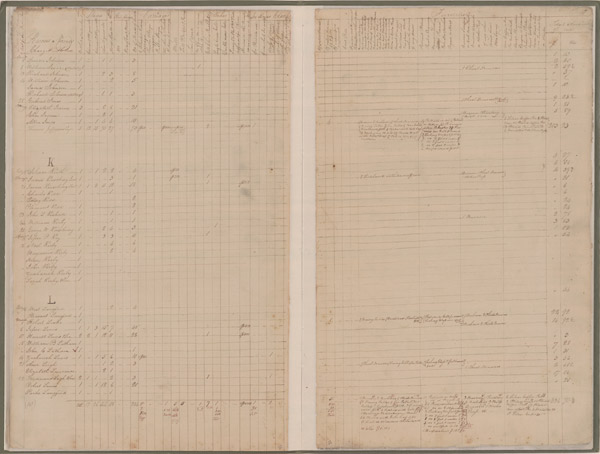

Virginia Memory This Day In Virginia History

Richmond Va Cost Of Living 2022 Is Richmond Va Affordable Data Tips Info